With the advent of NOUS and new financial markets, the regulations

governing that market change. This creates tremendous demand for

reliable transparency, providing simple technology for traders and

investors. Technology and possibilities that have been considered

science fiction a few years ago are now blockade

In fact with the introduction of Chinese technology (token). And also

investors with new opportunities such as starting or investing. The

investor has the ability to sell or exchange his assets. These

investment opportunities are very "user friendly" and do not require low

commissions and minimum amount of documents or bureaucracy. Everyone

can buy tokens. Create a company with a small fee fee. This new

development will create demand for new investment funds. Portfolio of

asset and cryptographic decryption. In addition, as tight

industry regulations, institutional investors find new opportunities in

this niche market. Encrypted assets will grow in the near future.https://nousplatform.com/docs/nousplatform_whitepaper_en.pdf

For example, stocks, futures, options and many other assets in the form

of new investments will be supplied as a cryptographic asset (token),

which will be offset by elimination and issuance.

Thanks to the functionality of the platform, investors will be able to

analyze the funds in their personal account. The statistics are formed

from snapshot data. With the help of a purse available on the platform,

investors will be able to store their Nous tokens and invest in other

funds.

New Generation Investment Fund

The creation of protocols is delegated to smart contracts that are operated as blockbusters. It is they who determine the conditions of interaction between depositors and funds. This protocol is required to grant permission. In addition, the ability to extend the capabilities of share contracts by linking third-party services. The plan will cover the market Rp 69, in the future.

Research conducted by Boston Consulting Group shows that assets managed by existing managers have reached more than sixty dollars of structural growth in above 7% by 2016. Nous acts as the main digital currency to regulate investor relations and funding. Depositors may purchase other portfolio assets in exchange for Nous.

We intend to open tokens that are transferred to reserves designed for a quick settlement with investors. These measures ensure liquidity of funds. An effective example of a good implementation can be considered right now (the largest investment fund). Capitalization has reached Rp 5 trillion. If you choose to work in a distributed manner, all transactions consist of Nous tokens. Another obvious example is the issuance of the ETF index via ICO.https://nousplatform.com/

NOUS token Ethereum

Investors can invest funds at any time by buying stocks. With Nous. NOUS is a utility token, available for purchase at: Password exchange. The ERC20 token standard has all the advantages associated with Ethereal, such as the use of a single wallet for all ERC20 tokens. If the investor wants to liquidate all or part of the stock, the token nous will be accepted at the current rate

Investors can choose from various funds to diversify their portfolio. He will decide whether to participate in the fund in accordance with the statistical survey of decision funds recorded in the block chain. Transparent ensures actual data that does not change. Nousprotocol noted in a snapshot, the block of investment portfolio port of each fund within a certain period of time is made. Statistics are available for review and analysis At any time, there is code that can be reviewed by public back office and open source smart contract public.

Investors can analyze funding activities in the back office. Fund-based statistical data shows the profitability of funds. In addition, it discloses asset redemption and acquisition and other portfolio modifications, liquidity index, token hold amount, total equity capital, and so on. Nous provides financial analysis and assessment tools. This report is available to all users and can be reviewed.

Token Distribution

Closed tokens for closed-fund fundraising and pre-sale are sold to the public. Proof of locked nous platform for the first 4 months, collected 20% of the month and collected at 5% per month. Total payment period is 24 months. Advisory tokens are locked for two months and are fully distributed. All unsold tokens in the crowd are burned.

Pilot investment fund When

sponsors get the NOUS mark during the sales event of the crowd, it becomes the first additional shareholder of two pilot funds. So the Nousplatform will be fully functional once you start.

Open the Fund

Here is a brief explanation of how Open Fund works. Therefore,

the unlimited funds system allows investors to acquire or sell shares. Investors have Nous token assets directly on the fund. The fund provides a token equity.

Stocks to investors. At all times, this approach allows funds to continue to improve liquidity, and investors can liquidate stocks at any time. This is a real situation. Investor costs on the acquisition and liquidation of shares of the cost of such funds. This cost is the benefit of the fund.

Real Estate Fund managed

in the areas of construction, leasing, financing and real estate sales. Real estate in Arizona, USA. One-time financing funds are listed on the cryptographic exchange as emissions tokens and then ETFs. This fund distributes the dividend to the ETF token holder. The NOUS token sponsor will receive an ETF value of 15% of the investment amount. The details are from the White Paper.

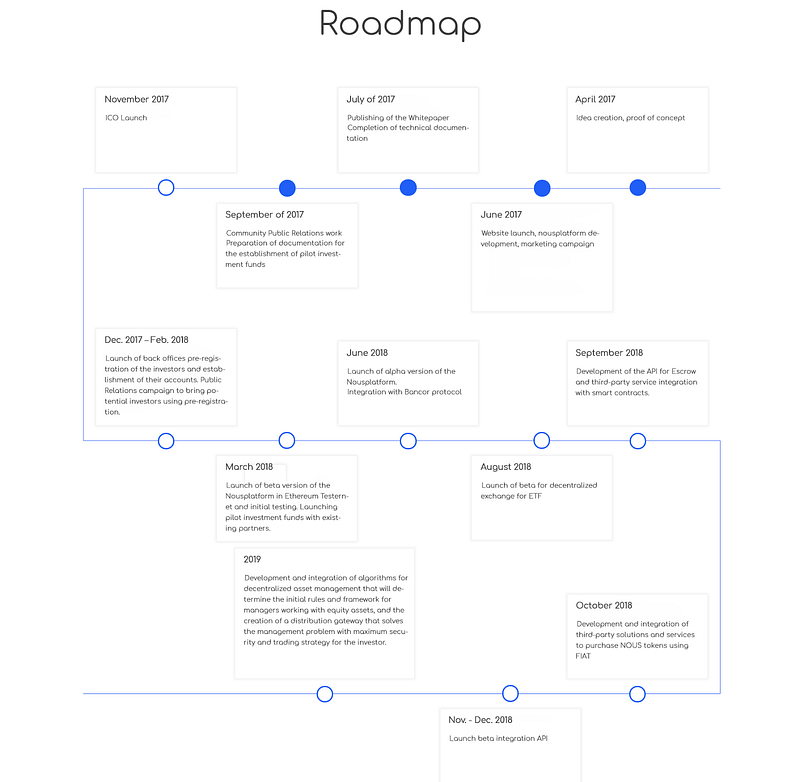

Lone map

2 017 April

the idea of establishment, research and proof-of-concept

in June 2017

website started, owned ICO released, development started

nous protocols and software platforms, early marketing campaigns.

July 2017

Completing the White Paper Publishing Technical Documentation

Public investment fund pilot Public Relations September 2017didirikan

The launch of ICO in November 2017

December 2017 - February 2018

The back office of the investor has registered and created their account.

Pre-registration promotional campaign to attract potential customers.

In March 2018, we will

launched a beta version of Nousplatform in Ethereum and started an initial test pilot investment with our existing partners.

Release of Nousplatform in June 2018. Bancor Protocol and 3rd party integration services.

August 2018

Launch Beta Exchange Distributed for ETF

September 2018

Develop APIs for integration of escrow services and third party Smart contracts.

October 2018

Develop and integrate third-party solutions and services Buy NOUS tokens using FIAT.

November-December 2018

launch of integrated API Beta

2019

Determine preliminary rules and frameworks for developing and integrating algorithms for distributed assets Create managers and distributions that act as managed equity assets Trading strategies for gateway investors to solve management problems with maximum security.

Said fund assets

the idea of establishment, research and proof-of-concept

in June 2017

website started, owned ICO released, development started

nous protocols and software platforms, early marketing campaigns.

July 2017

Completing the White Paper Publishing Technical Documentation

Public investment fund pilot Public Relations September 2017didirikan

The launch of ICO in November 2017

December 2017 - February 2018

The back office of the investor has registered and created their account.

Pre-registration promotional campaign to attract potential customers.

In March 2018, we will

launched a beta version of Nousplatform in Ethereum and started an initial test pilot investment with our existing partners.

Release of Nousplatform in June 2018. Bancor Protocol and 3rd party integration services.

August 2018

Launch Beta Exchange Distributed for ETF

September 2018

Develop APIs for integration of escrow services and third party Smart contracts.

October 2018

Develop and integrate third-party solutions and services Buy NOUS tokens using FIAT.

November-December 2018

launch of integrated API Beta

2019

Determine preliminary rules and frameworks for developing and integrating algorithms for distributed assets Create managers and distributions that act as managed equity assets Trading strategies for gateway investors to solve management problems with maximum security.

password limits and asset transactions using automatic open hedge bot trading funds and AI. NOUS sign acquired sponsorship distributed baekeo deposit For details of 15% of token investment funds information published in a white paper. Accumulation. Funding was acquired at 1000 for $ NOUS. Token. In addition, he / she must pay $ 150 tokens for the funds will receive $ 150 in the ETF real mark. After real estate

funds and hedge fund cryptocurrency automatically receive tokens in your wallet established sponsor commitment.

Resources:

Web: https://nousplatform.com/

WhitePaper: https://nousplatform.com/docs/nousplatform_whitepaper_en.pdf

Forum Forum Discussion: https://bitcointalk.org/index.php?topic=2236285

Facebook: https://www.facebook.com/nousplatform

Twitter: https://twitter.com/nousplatform

Telegram Chat: https://t.me/NousplatformEng

Tidak ada komentar:

Posting Komentar